Did you know that many restaurants fail not because of poor food quality or service but due to cash flow mismanagement? Running a successful restaurant isn’t just about crafting delicious dishes and providing exceptional service. Financial management plays a crucial role in ensuring long-term profitability. Among the many financial tools available, daily cash flow statements stand out as one of the most important for restaurant owners and managers. Additionally, using modern technology, such as the Call-The-Service App, can streamline cash flow tracking by helping in the automation of daily financial reporting and providing real-time insights into your revenue and expenses. Here’s why monitoring your daily cash flow is essential to the financial health of your business.

Understanding Cash Flow vs. Profit

Many restaurant owners make the mistake of assuming that if their business is profitable, they don’t need to worry about cash flow. However, profit and cash flow are not the same. A restaurant can be profitable on paper while still struggling with cash shortages due to slow invoice payments, unexpected expenses, or seasonal fluctuations. A daily cash flow statement helps you keep track of money coming in and going out, ensuring you have enough liquidity to cover daily operational costs.

Identifying Cash Flow Trends

By maintaining a daily cash flow statement, you can identify trends in your revenue and expenses. You’ll be able to answer key questions such as:

-

Are there certain days of the week when cash inflow is lower than expected?

-

Are there unexpected expenses draining your cash reserves?

-

Are slow days creating problems with paying suppliers and staff?

Recognizing these patterns allows you to make informed adjustments, such as implementing targeted promotions on slow days or negotiating better payment terms with suppliers.

Common Restaurant Expenses That Impact Cash Flow

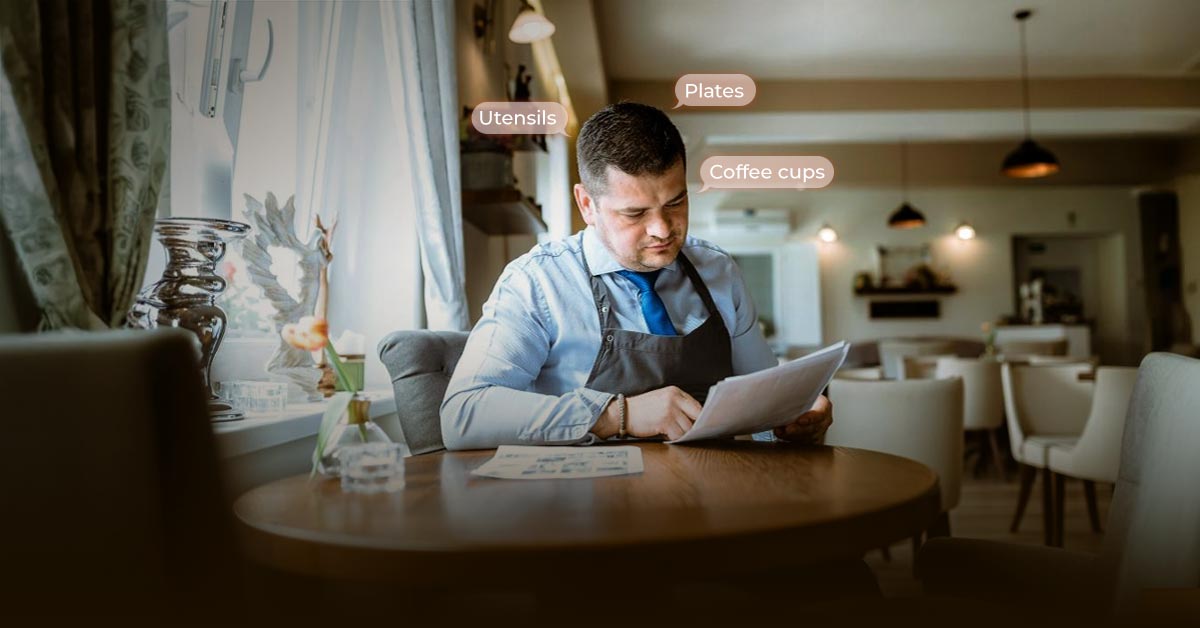

To effectively manage cash flow, restaurant owners must be aware of the numerous expenses that can impact their financial stability. Some of these expenses include:

-

Rent/Property Costs

-

Employee Salaries & Wages

-

Inventory Costs (Food, Beverages, Supplies)

-

Utilities (Electricity, Water, Gas, Internet, etc.)

-

Marketing & Advertising

-

Equipment & Maintenance

-

Insurance & Permits

-

Loan & Credit Repayments

The Financial Struggles of New Restaurants

The first few years of operating a restaurant come with high uncertainty. Many new businesses struggle with large initial investments and unexpected costs that can quickly drain cash reserves. Startup restaurants often rely on business loans and credit, but without a solid financial plan, debt repayment can quickly become overwhelming. To survive these early years, restaurant owners must:

-

Set realistic financial expectations and budgeting plans.

-

Ensure they have adequate working capital before opening.

-

Closely monitor expenses and avoid unnecessary spending.

-

Adjust operations quickly when cash flow issues arise.

Pay Attention to Profit & Loss Statements (P&L)

Your restaurant may be selling out every night, but if you’re spending more than you’re making, you’re still at risk of failure. A profit & loss statement (P&L) provides an overview of income and expenses over a given period, helping you:

-

Pinpoint areas of unnecessary spending.

-

Identify cost-cutting opportunities.

-

Make informed decisions about menu pricing and expenses.

Creating Seasonal Budgets

Many restaurants experience seasonal fluctuations, making it crucial to adjust budgets quarterly rather than annually. A seasonal budget helps restaurants:

-

Anticipate slow months and cut unnecessary expenses.

-

Prepare for peak seasons by increasing inventory and staffing.

-

Strategically time large purchases (equipment, renovations, etc.).

Avoiding the Pitfall of Relying on Credit

Using credit cards and loans can provide temporary relief, but over-reliance on borrowed money leads to long-term cash flow problems due to high-interest rates and repayment obligations. To avoid this:

-

Use credit strategically and only when necessary.

-

Pay off balances quickly to avoid accumulating debt.

-

Seek alternative funding sources, such as investor capital or grants.

Building Emergency Cash Reserves

When your restaurant is experiencing strong profits, it’s wise to set aside at least 20% of profits as a cash reserve for slow periods or unexpected expenses. Having an emergency fund helps:

-

Avoid reliance on credit during downturns.

-

Cover unexpected repairs or maintenance costs.

-

Maintain financial stability during economic uncertainties.

Optimizing Payroll to Improve Cash Flow

Labor costs are one of the biggest expenses for restaurants. To optimize payroll:

-

Hire temporary staff during peak seasons.

-

Schedule employees efficiently based on demand.

-

Train managers to cover shifts instead of overstaffing.

Inventory Management’s Impact on Cash Flow

Poor inventory management can quickly drain cash reserves. To avoid unnecessary costs:

-

Take inventory regularly to prevent over-purchasing.

-

Minimize food waste by using FIFO (First-In, First-Out) stock rotation.

-

Plan menu specials around surplus ingredients to reduce waste.

Generating Additional Revenue Streams

One way to increase cash flow is by offering additional services such as:

-

Catering services for events and businesses.

-

Private dining experiences or venue rentals.

-

Loyalty programs and promotions to attract repeat customers.

Staggering Outgoing Payments

Instead of making all payments at once, restaurants can stagger expenses to maintain cash flow balance:

-

Schedule supplier payments strategically.

-

Negotiate payment terms with vendors.

-

Automate bill payments to avoid late fees.

Using Marketing to Boost Cash Flow

Marketing plays a key role in maintaining steady revenue. To attract more customers:

-

Run promotions such as happy hour deals or limited-time discounts.

-

Utilize social media and online advertising.

-

Host special events, such as cooking classes or wine tastings.

How to Create and Maintain a Daily Cash Flow Statement

Creating daily cash flow statements doesn’t have to be complicated. Follow these steps:

-

Record Cash Inflows: Track revenue from sales, catering, and events.

-

Record Cash Outflows: List all expenses, including payroll, rent, and utilities.

-

Calculate Net Cash Flow: Subtract total outflows from total inflows.

-

Review and Adjust: Identify trends and make necessary changes.

Conclusion

Daily cash flow statements are a critical financial tool for restaurant owners. By monitoring cash flow, preparing for seasonal changes, optimizing payroll, managing inventory effectively, and leveraging additional revenue streams, you can keep your restaurant financially stable and prepared for future challenges. Start tracking your daily cash flow today to gain better control over your restaurant’s finances and long-term success.